Banks IFSC Code and address details

Alwasy need to add correct IFSC Code while doing NEFT/IMPS/RTGS transaction to avoid transaction failure, sometimes wrong ifsc code may lead to wrong transaction to wrong account or dead account.

What is an IFSC Code?

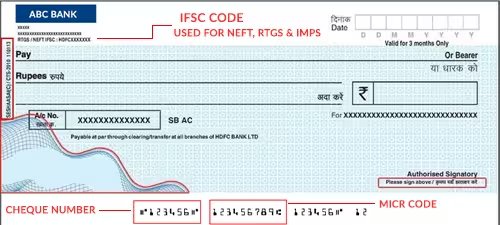

FSC is an acronym for Indian Financial System Code. It is an 11-digit unique number of alphabets and numerals that uniquely identifies a bank branch. The IFSC is mainly used to transfer funds online for NEFT, IMPS, or RTGS transactions.

The IFSC code of the respective branch is mentioned in the chequebook of the account holder or on the front page of the passbook. Moreover, an account holder can check the code of their bank branch on the website of Reserve Bank of India.

It is to be noted that IFSC plays a very important role in online fund transfer. Internet banking transactions for transferring funds cannot be initiated without a valid Indian Financial System Code. Also, the 11-digit IFSC code is generally not changed or updated subject to any merger or any official need. Recently, the State Bank of India changed the IFSC of all the branches after the merger with five associate banks and Bhartiya Mahila Bank.